This year, health technology in China is entering a rapid-change phase — a transformation shaped not only by new laws and government policies, but by the growing appetite for cutting-edge medical devices. As the global medical community eyes these shifts, this story might define where the next big breakthroughs in medtech come from.

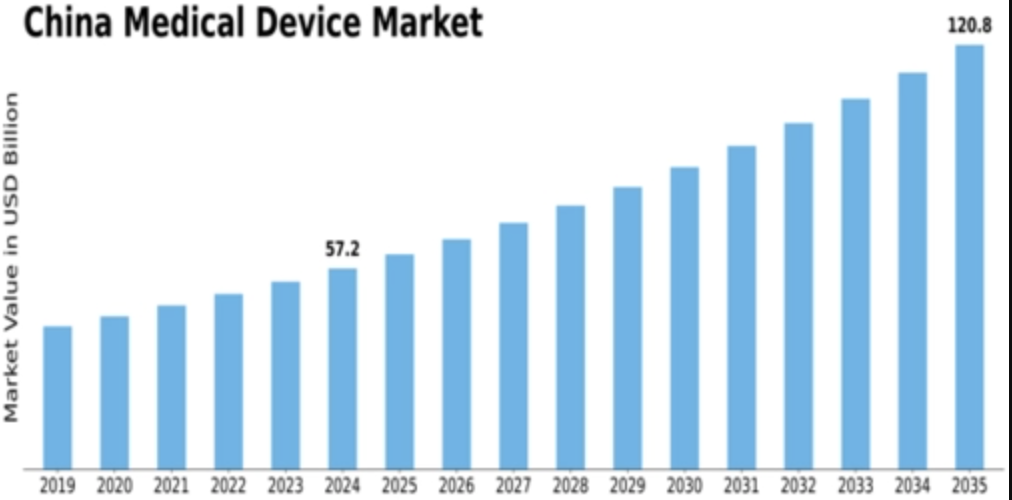

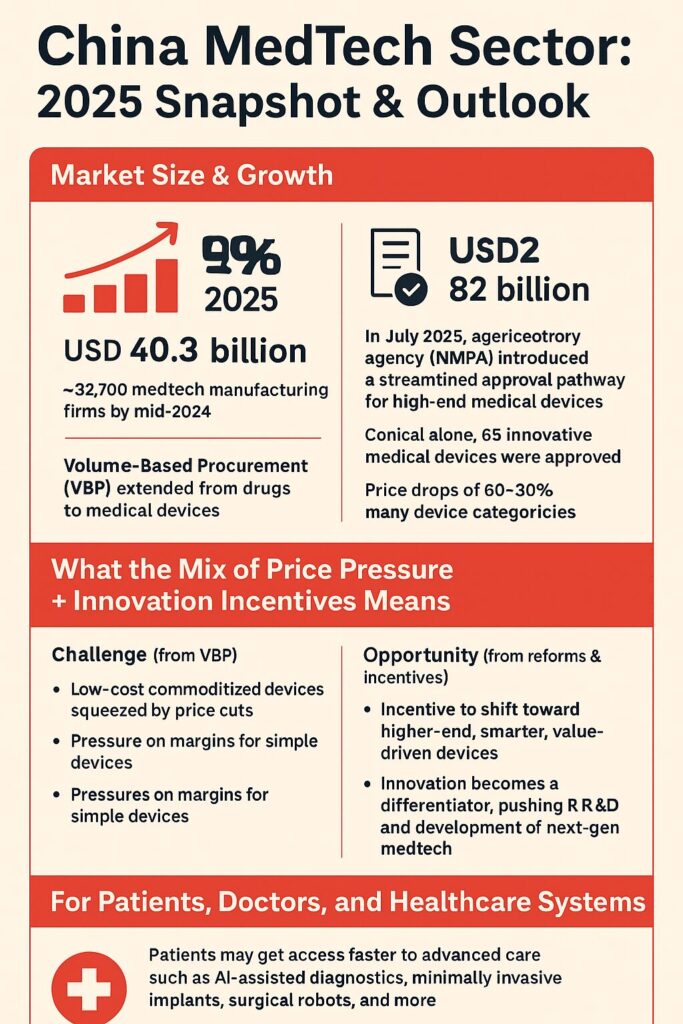

In 2024, China’s medical-devices market was estimated at USD 40.3 billion — and analysts expect it to nearly double by 2032, reaching over USD 82 billion.

Musumeci Online – The Podcast. It is perfect for driving, commuting, or waiting in line!

But numbers only tell part of the story. What matters more is how the industry is changing — from regulation and procurement to innovation and global integration.

What’s Changing: New Rules, Faster Approvals, Big Market Pressure

Regulatory overhaul for high-end & AI devices

In July 2025, China’s regulatory authority National Medical Products Administration (NMPA) issued a major update to support “high-end medical devices” — ranging from surgical robots and AI diagnostic tools to advanced imaging systems. This new roadmap simplifies approval paths, standardizes device classification, and speeds up market entry for innovation-focused products.

As a result, in 2024 the NMPA approved 65 innovative medical devices, a modest but meaningful increase compared to previous years.

Volume-Based Procurement puts pressure — and incentives

Since 2019, a policy called Volume‑Based Procurement (VBP) has expanded from drugs to medical devices. The goal: centralize purchases and drive down prices via large tenders — but that comes with strong price pressure. Some device prices dropped 60–90%.

At first glance, that might seem like bad news for innovation. But the policy also pushes companies to compete on value — driving higher-end, smarter, more efficient devices. In other words: when low-cost commoditised items get squeezed, quality and innovation become the differentiator.

Incentives for innovation and early access

To support high-end medical tech, regulators have paired these procurement policies with special review pathways and early access schemes. These allow devices that meet certain standards to reach hospitals faster — often based on real-world evidence rather than long clinical trials.

This creates a rare opportunity: innovation can move at speed, address real patient needs, and scale quickly.

How This Affects MedTech Innovation & Global Players

With these regulatory, policy, and market changes, China becomes not just a large market — but a fast-adapting laboratory for next-generation medical technology.

- Rapid adoption of AI-based devices: Since AI-driven software is classified under the high-end bracket, companies developing algorithmic diagnostics, surgical assistants, or imaging tools have a clearer path for approval and reimbursement.

- Global opportunities for manufacturers: As China opens up to imported or locally-produced high-end devices, international firms with strong R&D may find demand growing fast — provided they align with new regulations.

- Lower cost, higher reach: The combination of price pressure (via VBP) and innovation incentives could make advanced medical devices more affordable, expanding access not only to big hospitals, but to smaller clinics and underserved regions.

What This Means for Patients, Healthcare Systems, and the Future of Medicine

For patients, this shift could translate into faster access to cutting-edge treatments: from minimally invasive implants, to AI-assisted diagnostics, to affordable surgical robots. For doctors and hospitals, it means better tools — and perhaps less reliance on outdated equipment.

On a broader scale, it signals a global trend: innovation + regulation + scale. When a huge market like China combines these elements, it can accelerate technological maturity — and push medtech forward for the rest of the world.

It’s not just about devices — it’s about making next-generation medicine accessible at scale.

quick facts table

| Metric / Trend | 2024 / Recent Data | Significance |

|---|---|---|

| Market value of China medical device market (2024) | USD 40.3 billion (Fortune Business Insights) | Baseline market size, showing scale & opportunity |

| Forecasted market size (2032) | USD 82 billion (Fortune Business Insights) | Indicates nearly doubling market in less than a decade |

| Number of innovative devices approved by NMPA (2024) | 65 devices (cisema.com) | Signals regulatory openness to innovation |

| Typical price reduction due to VBP policy | 60–90% on many device categories (lek.com) | Reflects cost pressure and shift to value devices |

| Growth in number of medtech manufacturing enterprises (2022–2024) | ~ 8.5% growth, reaching 32,700 firms (June 2024) (Acclime China) | Shows expanding industrial capacity and local production potential |

Final Thoughts: A MedTech Revolution in Motion

2025 may go down as a turning point in global medical technology — not because of a single breakthrough, but because a large, dynamic market like China has aligned policy, regulation, innovation and demand all at once.

If you follow medtech trends, watch carefully: the devices, tools, and ideas born in China’s labs and hospitals today may define what becomes standard in surgeries, diagnostics, and patient care worldwide in just a few years.

Because when innovation meets scale — and regulations enable it — medicine can evolve faster than we ever imagined.

Leave a Reply